Banking & Credit :: UNITED BANK OF INDIA

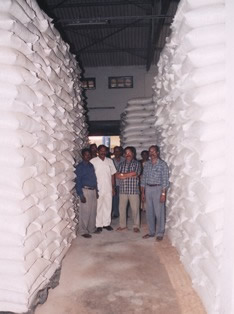

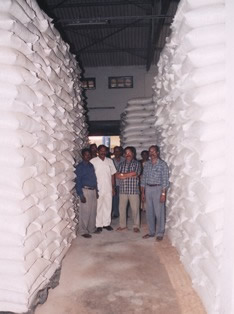

6. Gramin Bhandaran Yojana

Objective:

i. Creation of scientific storage capacity with allied facilities in rural areas to meet the storage need of farmers for farm produce, consumer articles and agricultural inputs.

ii. Promotion of grading, standardization and quality control of agricultural produce for improving their marketability and preventing distress sale.

iii. Promotion of pledge financing and marketing credit and to strengthen agricultural marketing infrastructure for introduction of a national system of warehouse receipts in respect of agricultural commodities stored in such godowns.

Implementation:

i. The scheme is implemented by the Directorate of Marketing and Inspection attached to Department of Agriculture and Cooperation. Implementation of the scheme shall be continued up to 31.03.2007.

ii. The construction of godowns shall be as per specifications of Central / State / Public Works Dept. or any other specifications laid down on this behalf.

iii. The godown complex shall have easy approach road, pucca internal roads, proper drainage, arrangements for effective control against fire, theft and also have arrangements for easy loading and unloading of stocks.

iv. The entrepreneur must have proper licence to operate such godowns under the State Warehousing Act or any other relevant law.

v. The project to be prepared by the borrower, acceptable to the bank and submitted along with approved plan & estimated cost by an approved engineer.

vi. Average DSCR should not be below 1.5 and in any year it should not be less than 1.33.

vii. As this is a subsidy based scheme disbursement to be made only after receiving of 50% advance subsidy.

Eligibility: The project for construction of rural godown can be taken up by :

|

i. |

Individual Farmers |

v. |

Partnership /

Proprietorship concern |

ix. |

Agricultural Produce Marketing |

ii. |

Group of farmers |

vi. |

|

x. |

Marketing Board |

iii. |

NGOs |

vii. |

Corporations |

xi. |

Agro Processing Corporations

|

iv. |

SHGs |

viii. |

Cooperative Societies |

|

|

7. Golden Jubilee Rural Housing Finance Scheme

Objective:

To redress the problem of rural housing through improved access to housing credit in rural areas, for construction of house, purchase of house/flat under construction or purchase of newly built ready house /flat /repair /renovation /extension etc.

Eligibility:

An individual customer including joint loanees, salaried persons professional and self employed business men and agriculturists having regular source of income. Promoters/Co-operative Societies/Associations/Staff are not eligible under the scheme.

Quantum of loan:

There is no ceiling on the quantum of loan provided by banks under the scheme. All loans extended by the banks in rural areas for housing purposes be included under the captioned scheme. However, it may be noted that refinance facility from NHB shall be limited up to a maximum of Rs.15.00 lac per dwelling unit under the scheme.

|